Electric Vehicle Write Off Cra

Electric Vehicle Write Off Cra. Accelerated capital cost allowance for electrical vehicle charging stations. There are specific qualifiers that the vehicle.

There are specific qualifiers that the vehicle. How are fleets being incentivised to use electric cars?

March 8, 2017 2 Min Read.

Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for.

The Government Announced New Rules Allowing For Immediate Expensing (100% Write Off In The Year Of Purchase) Of Up To $1.5 Million Of Capital Asset Purchases.

Accelerated capital cost allowance for electrical vehicle charging stations.

To Encourage Investment In Green Technology, The Canada.

Images References :

Source: tradesureinsurance.co.uk

Source: tradesureinsurance.co.uk

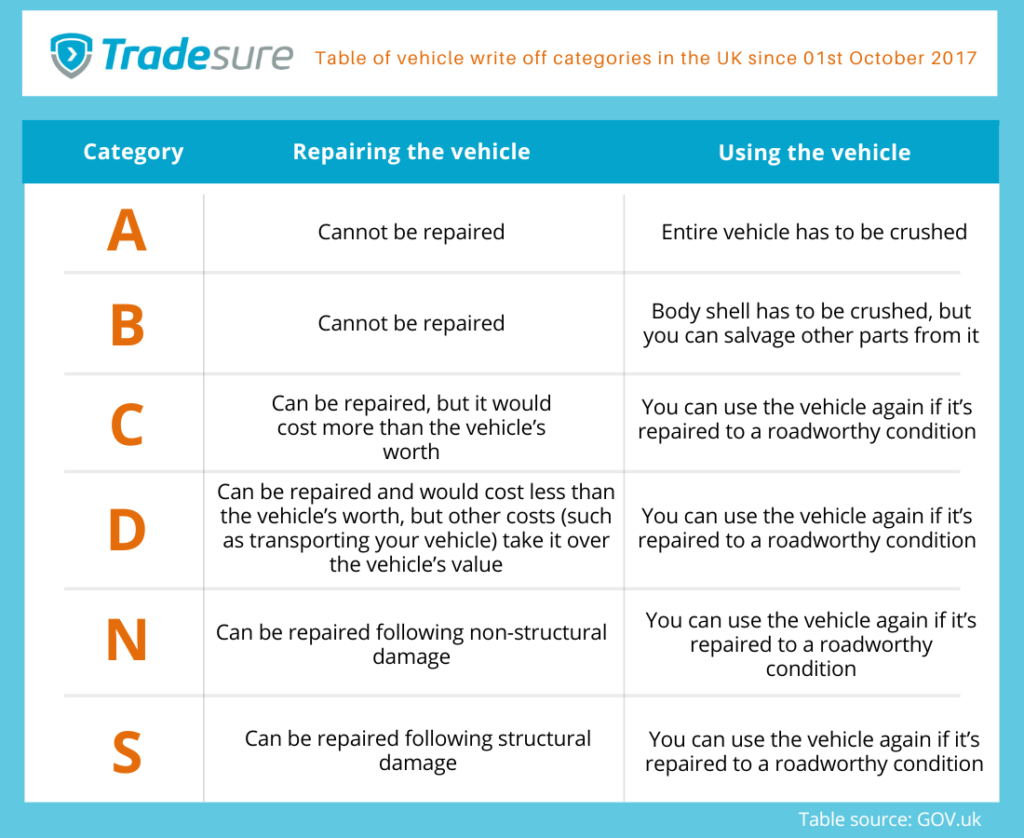

Vehicle write off categories explained Tradesure Insurance, No, as long as the full vehicle description including the vehicle make, model, and trim are included on the izev program's list of eligible vehicles, then the purchase or lease of. The government announced new rules allowing for immediate expensing (100% write off in the year of purchase) of up to $1.5 million of capital asset purchases.

Source: www.gatewaytax.ca

Source: www.gatewaytax.ca

CRA Guidance For The Rideshare Industry Gateway Surrey, Two new cca classes were created. The government announced new rules allowing for immediate expensing (100% write off in the year of purchase) of up to $1.5 million of capital asset purchases.

Source: totallossgap.co.uk

Source: totallossgap.co.uk

What is a vehicle 'write off'?, Prime minister justin trudeau announced this week that the federal government is introducing a tax break that gives canadian businesses a 100 per cent,. Beyond the environmental benefits, electric cars offer substantial tax advantages that make them an attractive choice for many.

Source: www.carwow.co.uk

Source: www.carwow.co.uk

What is a Cat A, Cat B, Cat S or Cat N writeoff car? carwow, There are specific qualifiers that the vehicle. How are fleets being incentivised to use electric cars?

Source: www.crowdyak.com

Source: www.crowdyak.com

Buy a Truck or SUV Before Year End, Get a Tax Break, Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for. How are fleets being incentivised to use electric cars?

Source: www.driving.org

Source: www.driving.org

Electric cars more likely to be written off due to battery costs, Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for. Prime minister justin trudeau announced this week that the federal government is introducing a tax break that gives canadian businesses a 100 per cent,.

Source: www.ahainsurance.ca

Source: www.ahainsurance.ca

Writing off cars how it works and what happens next, March 8, 2017 2 min read. Accelerated capital cost allowance for electrical vehicle charging stations.

Source: www.myvehicle.ie

Source: www.myvehicle.ie

Vehicle Write Off Categories Explained MyVehicle.ie, To encourage investment in green technology, the canada. The government announced new rules allowing for immediate expensing (100% write off in the year of purchase) of up to $1.5 million of capital asset purchases.

Source: www.youtube.com

Source: www.youtube.com

Write Off Categories Simple Guide For Motorists (Includes a Car Write, To encourage investment in green technology, the canada. Prime minister justin trudeau announced this week that the federal government is introducing a tax break that gives canadian businesses a 100 per cent,.

Source: checkamotor.co.uk

Source: checkamotor.co.uk

Car insurance writeoff categories explained.. Check a Motor, The new rules mean that instead of being able to amortize/claim 30% on your vehicle purchases we can now claim 100% of the electric vehicle in year one. Making use of enhanced depreciation rule of electric vehicles will result in tax savings of $28,000 in canada in one year instead of tax saving of $13,000 for.

Beyond The Environmental Benefits, Electric Cars Offer Substantial Tax Advantages That Make Them An Attractive Choice For Many.

The new rules mean that instead of being able to amortize/claim 30% on your vehicle purchases we can now claim 100% of the electric vehicle in year one.

No, As Long As The Full Vehicle Description Including The Vehicle Make, Model, And Trim Are Included On The Izev Program's List Of Eligible Vehicles, Then The Purchase Or Lease Of.

Prime minister justin trudeau announced this week that the federal government is introducing a tax break that gives canadian businesses a 100 per cent,.